Why is the governor freezing an 8/10 cent gas tax just before voters are expected to decide on a 1 cent transportation tax? Why do we need T-SPLOST when we could use that gas tax instead?

According to the Governor’s own press release:

According to the Governor’s own press release:

Friday, June 8, 2012

Gov. Nathan Deal announced today that he will stop an increase in the motor fuel tax scheduled to go into effect on July 1. Using the formula established in state law, the Department of Revenue determined that average gas prices over the past six months call for the motor fuel tax to rise to 12.9 cents per gallon from 12.1 cents per gallon.

With that 0.8 cent gas tax, why would we need the 1 cent T-SPLOST sales tax? That 0.8 cent gas tax would have gone into effect just before the 31 July 2012 primary election, when voters till vote on the T-SPLOST referendum. T-SPLOST, which is a one cent sales tax. And a gasoline tax is paid by people who actually use the roads, not by every pedestrian who buys food.

The governor’s PR also said:

“We’re seeing a slow and steady rebound in Georgia’s economy, with our unemployment rate going down and state revenues heading up, but Georgians are still paying gas prices that are high by historical standards,” Deal said in a statement. “The state should not add to that burden at this juncture.”

“We’re seeing a slow and steady rebound in Georgia’s economy, with our unemployment rate going down and state revenues heading up, but Georgians are still paying gas prices that are high by historical standards,” Deal said in a statement. “The state should not add to that burden at this juncture.”

But we should increase everyone’s food prices with a T-SPLOST tax? How does that make sense?

The governor’s PR also says:

The governor of Georgia has the power to suspend collection of a tax, but the action requires ratification from the General Assembly.

Oh, but this freeze only lasts until January, and the General Assembly doesn’t meet until then. How convenient!

-jsq

State Court Judge John Edwards came before the Lowndes County Board of Commissioners

to ask them to begin the process of asking for an additional State

Court Judge for Lowndes County. An additional State Court Judge

would have to be authorized by the Georgia Legislature, then filled

initially by an appointee by the Georgia Governor.

State Court Judge John Edwards came before the Lowndes County Board of Commissioners

to ask them to begin the process of asking for an additional State

Court Judge for Lowndes County. An additional State Court Judge

would have to be authorized by the Georgia Legislature, then filled

initially by an appointee by the Georgia Governor.

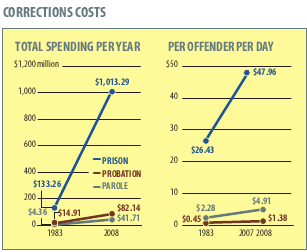

the like. We know that they work. We know the recidivism rate, if they go

through those approaches rather than directly into the prison system. We

have less recidivism. We break the addictions, and we’ve got to work

very closely on that.”

the like. We know that they work. We know the recidivism rate, if they go

through those approaches rather than directly into the prison system. We

have less recidivism. We break the addictions, and we’ve got to work

very closely on that.”