In Europe it’s already happening: solar and wind are causing

bond-rater Moody’s to warn of downgrades of energy companies

that depend on heat from burning coal, gas, or biomass.

Moody’s earlier even warned the Bank of England

of a potential carbon bubble developing.

If combustion energy plants are affected like this,

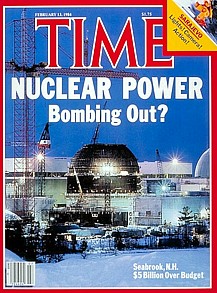

the credit effects will be even bigger on even-more-expensive

nuclear plants, which Moody’s called a

bet-the-farm risk way back in 2009.

In Europe it’s already happening: solar and wind are causing

bond-rater Moody’s to warn of downgrades of energy companies

that depend on heat from burning coal, gas, or biomass.

Moody’s earlier even warned the Bank of England

of a potential carbon bubble developing.

If combustion energy plants are affected like this,

the credit effects will be even bigger on even-more-expensive

nuclear plants, which Moody’s called a

bet-the-farm risk way back in 2009.

James Murray wrote for businessGreen 6 Nov 2012, Moody’s: Renewables boom poses credit risk for coal and gas power plants: Credit ratings agency warns increases in renewable power have had ‘a profound negative impact’ on the competitiveness of thermal generation companies,

“Large increases in renewables have had a profound negative impact on power prices and the competitiveness of thermal generation companies in Europe,” said Scott Phillips, an assistant vice president and analyst at Moody’s Infrastructure Finance Group, in a statement.

“What were once considered stable companies have seen their business models severely disrupted and we expect steadily rising levels of renewable energy output to further affect European utilities’ creditworthiness.”

And not just rising, rising increasingly Continue reading