U.S. too late to catch up with the competition,

says one analyst.

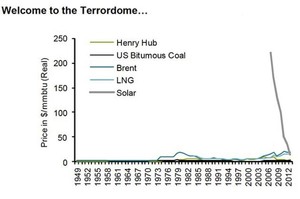

And solar is going to eat fracked methane’s lunch, say I.

US LNG exports according to the EIA

Colin Chilcoat, Oilprice.com, 16 December 2014,

LNG Export Hopes Fading Fast For US,

The advent of liquefied natural gas (LNG) has revolutionized the way

the commodity is transported and has brought increased parity to

traditional pipeline relationships. In that regard, the United

States’ natural gas boom was right on time. However, somewhat slow

to react to market demand, the US may just be missing its window….

Approximately 80 percent of future capacity will be sourced from

Australia, Canada, East Africa, Russia, and the United States. In

the early goings, the field — namely Australia — has the

jump on North America….

Russia, while also slow to react, cannot be counted out. President

Vladimir Putin has sought to aggressively expand his country’s Asian

market share following the conflict in Ukraine. While profitability

is certainly is a concern, the government has demonstrated a

willingness to push through prestige projects. The upcoming Power of

Siberia pipeline will dampen LNG growth in China moving forward. The

country is also working closely with India on nuclear and LNG

cooperation.

Yep, Russia’s deal to sell Siberian gas to China undercuts

the world’s largest market for U.S. LNG exports, as I mentioned

14 November 2014.

Back to the United States, a long regulatory process and a

historical preference to keep hydrocarbons at home have delayed

efforts to export LNG. Moreover, the relatively useless LNG import

facilities, constructed pre-shale boom, serve as a reminder of how

quickly fortunes can change.

Fortunes can change even quicker towards the fastest-growing industry

in the world: solar power.

When even the nation’s most corrupt state (Georgia) is half way

through passing a solar financing bill (HB 57),

the world is turning to the sun.

Add to that OPEC’s deliberate crashing of oil and gas prices, and:

So to recap: we’re looking at an already saturated market with

little opportunity to make a buck. Sabine Pass and likely Cameron

will have their chance, but the window is all but closed.

So the

long lists of approved, proposed, and potential LNG export terminals

may be largely pipe dreams (pun intended).

And Sabine Pass and Cameron’s main market might end up being:

Florida via Port Dolphin.

Which if it causes the Sabal Trail pipeline to be cancelled

would be some improvement.

Meanwhile, the more delay in all the fracking boondoggles, including pipelines and exports,

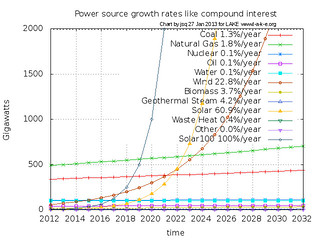

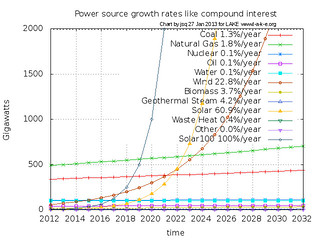

the more people will realize solar power will produce more energy than any other U.S. source in less than a decade.

Fossil fuel companies brag about potential 28% growth in shale gas over 28 years,

while solar power already doubled twice in four years and is set

to continue that compound interest growth rate for years to come due to economies of scale.

And then innovations like improved storage will drive solar adoption even faster.

Former FERC Chair Jon Wellinghoff said in 2013,

“Solar is growing so fast it is going to overtake everything,” and the actual deployment numbers show he was right.

Meanwhile, the more delay in all the fracking boondoggles, including pipelines and exports,

the more people will realize solar power will produce more energy than any other U.S. source in less than a decade.

Fossil fuel companies brag about potential 28% growth in shale gas over 28 years,

while solar power already doubled twice in four years and is set

to continue that compound interest growth rate for years to come due to economies of scale.

And then innovations like improved storage will drive solar adoption even faster.

Former FERC Chair Jon Wellinghoff said in 2013,

“Solar is growing so fast it is going to overtake everything,” and the actual deployment numbers show he was right.

The smart money is not on doubling down on climate catastrophe through fracking.

Fixing climate change is profitable,

including investing in safer, faster, cleaner solar power now.

-jsq