The same money would buy a lot more electricity through solar power than that fracked methane pipeline could generate.

Update 2 March 2017: Added tables; fixed some typos.

Ramez Naam, his blog, 21 September 2016,

New Record Low Solar Price in Abu Dhabi — Costs Plunging Faster Than Expected

Start with Sabal Trail’s numbers

Let’s use Sabal Trail’s own assumptions, from Sabal Trail Project, Draft Resource Report 10: Alternatives, June 2014, Section 10.3.3 Non-Gas Energy Alternatives.

Page 10-6, in Wind Power:

The proposed Project, upon completion, would provide 1,100,000 de katherms per day of additional energy, which, when converted to megawatt hours (“MWh”) is approximately 322,580 MWh. To compare the energy provided by the proposed Project to that of other renewable energy sources, such as wind or solar, a unit of power must be calculated. The equivalent of 322,580 MWh is 26,882 MW of power, assuming 12 hours of operation.

Page 10-6, in Solar Power:

Some of the largest completed solar photovoltaic power plants, also called solar parks or fields, have area efficiency of about 4.5 to 13.5 acres per MW (Solar by the Watt, 2009). Therefore, it is estimated that the land requirements for a solar project that could produce 26,882 MW of power would range between 1,991 and 5,974 acres of permanent disturbance.

We already examined acreage way back in 2014, and found by Sabal Trail’s own numbers that half the acreage of the pipeline’s right of way could produce just as much electricity through solar power. That’s even before solar power costs fell further in the intervening three years.

What does utility-scale solar electricity cost?

Now let’s look at cost.

Christian Roselund, pv magazine, 19 July 2016, Deutsche Bank: U.S. utility-scale solar costs to fall below $1 per watt,

In terms of overall project costs, Shah says that solar power contracts in the United States are currently being offered at less than $0.05 per kilowatt-hour, with prices under $0.04 in North Carolina for contracts to supply power in late 2017.

$0.05 per kilowatt-hour is $50 per megawatt-hour (MWh).

Mark Bolinger, Samantha Weaver, Jarett Zuboy, Lawrence Berkeley National Laboratory, May 2015, Is $50/MWh Solar for Real? Falling Project Prices and Rising Capacity Factors Drive Utility-Scale PV Toward Economic Competitiveness,

Recently announced low-priced power purchase agreements (PPAs) for U.S. utility-scale PV projects suggest $50/MWh solar might be viable under certain conditions….

Based on these trends, a pro-forma financial model suggests that $50/MWh utility-scale PV is achievable using a combination of aggressive-bu-achievable technical and financial input parameters (including receipt of the 30% federal investment tax credit). Although the U.S. utility-scale PV market is still young, the rapid progress in the key metrics documented in this paper has made PV a viable competitor against other utility-scale renewable generators, and even conventional peaking generators, in certain regions of the country.

More about subsidies below. First let’s finish our calculations.

That LBNL paper apparently didn’t use any data newer than 2013. And Deutsche Bank says actual contracts are already being offered for $50/MWh. Is that the lowest? Nope.

The current record: $24/MWh

Abu Dhabi in September 2016 got a low bid of $24.00/MWh.

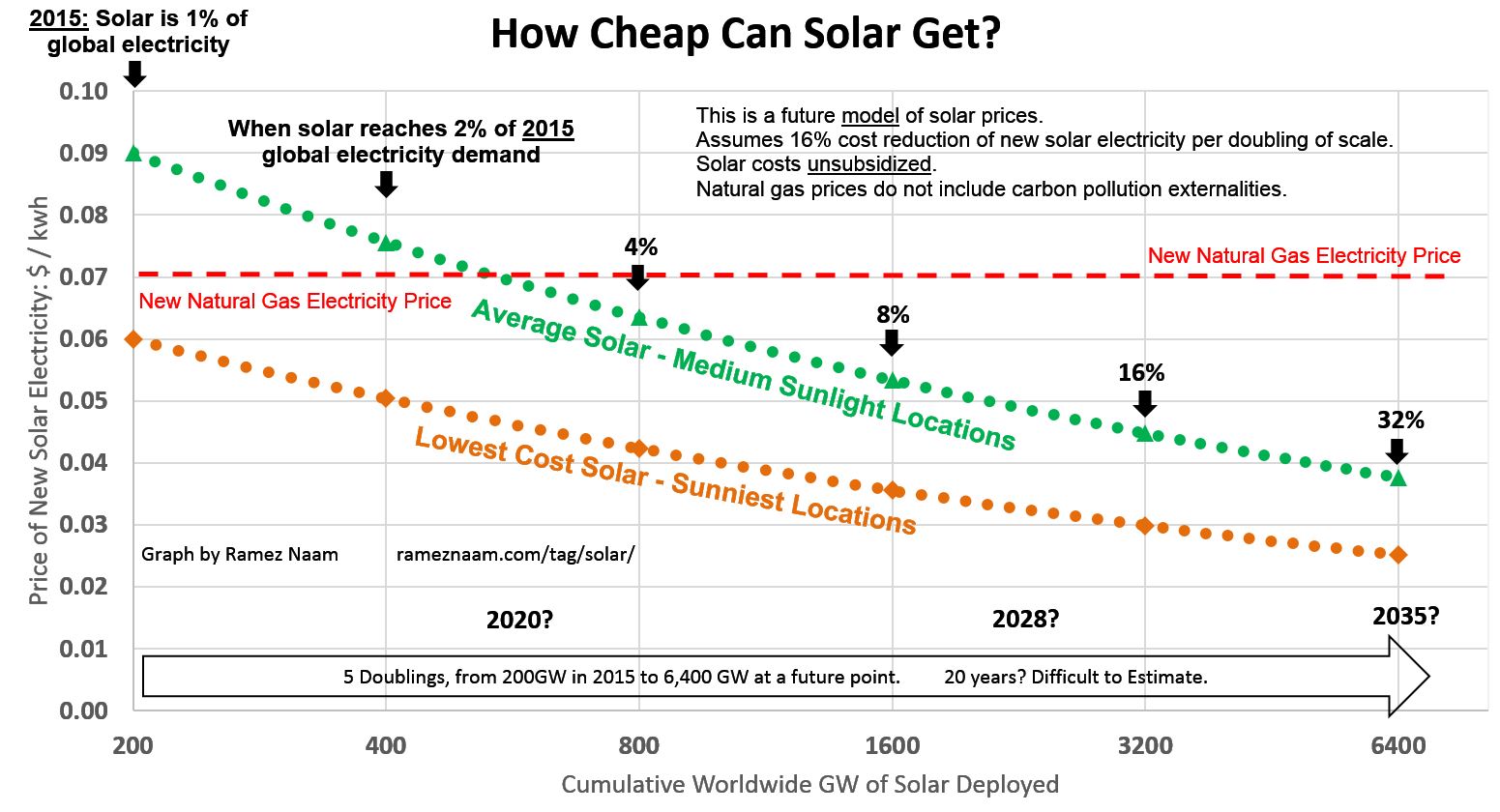

Ramez Naam, his blog, 21 September 2016, New Record Low Solar Price in Abu Dhabi — Costs Plunging Faster Than Expected

That is an unsubsidized price.

Let me put that in perspective. The cost of electricity from a new natural gas powerplant in the US is now estimated at 5.6 cents / kwh. (pdf link) That is with historically low natural gas prices in the US, which are far lower than the price of natural gas in the rest of the world.

This new bid in Abu Dhabi is less than half the price of electricity from a new natural gas plant.

What’s more, it’s less than the cost of the fuel burned in a natural gas plant to make electricity — without even considering the cost of building the plant in the first place.

He doesn’t mention without even considering the cost of building the pipeline to get the fracked methane to the natural gas plant.

Ramez Naam continues:

The solar bid in Abu Dhabi is not just the cheapest solar power contract ever signed — it’s the cheapest contract for electricity ever signed, anywhere on planet earth, using any technology.

Nor is this bid a fluke. Three other bids in Abu Dhabi’s latest power auction came in at less than 3 cents / kwh:….

OK, Abu Dhabi is in the middle east where the sun shines all the time, so prices probably aren’t that low in the U.S.

Computations at $50/MWh

So let’s use $50/MWh to start with, for utility-scale solar power.

Cost of 322,580 MWh of solar power

Sabal Trail says their pipeline would produce 322,580 MWh of electricity. They figure solar power would only operate 12 hours, half the day. So we’d need twice that number of MWh, or 645,160 MWh from utility-scale solar. Multiply by $50/MWh for the cost and that’s $32,258,000. That’s a bit more than $32 million for the solar power. Not the $32 billion the pipeline costs FPL ratepayers. Suppose the solar power plants only generate four hours a day; multiply by 6 instead of 2, or effectively $300/MWh instead of $50/Mwh. Or just multiply the total dollars we already got by 3, for $96,774,000. $97 million is still way less than $3.2 billion. About 33 times less.

| Price/MWh | Hours /Day |

Tax Credit |

Cost | $32 billion /Cost | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $50/MWh | 12 h/day | 30% | $32,258,000 | 99 | ||||||||||||||||||||

$50/MWh

|

4 h/day

|

30%

|

$96,774,000

|

33

|

$50/MWh

|

4 h/day

|

0%

|

$138,248,571

|

23

|

$225/MWh | ($4.50/Watt)

12 h/day

|

30%

|

$145,161,000

|

22

|

$225/MWh | ($4.50/Watt)

4 h/day

|

30%

|

$435,483,000

|

7.35

|

$225/MWh | ($4.50/Watt)

4 h/day

|

0%

|

$622,118,571

|

5.14

| |

The table contains some additional rows from numbers we’ll discuss below.

How much solar power can $3.2 billion buy?

To put it another way, how much electricity could $3.2 billion of

utility-scale solar produce?

That $3.2 billion is the price tag FPL’s ratepayers are stuck with for Sabal Trail

and Florida Southeast Connection.

Suppose Sabal Trail’s estimate of solar generation only half the day,

so we have to buy twice as many panels, or call it $100/MWh.

Divide $3,200,000,000 by $100/MWh to get 32,000,000 MWh.

Maybe we only get solar power 4 hours a day, so that would be 6 * $50 = $300/MWh

Or just divide the above result by 3 to get 10,666,666 MWh.

That still seems quite a bit more than Sabal Trail’s 645,160 MWh 322,580 MWh.

About 33 times more; same factor we got by the other computation.

| Price/MWh | Hours /Day |

Tax Credit |

Solar MWh | Solar MWh /322,580 MWh | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| $50/MWh | 12 h/day | 30% | 32,000,000 MWh | 99 | ||||||||||||||||||||

$50/MWh

|

4 h/day

|

30%

|

10,666,666 MWh

|

33

|

$50/MWh

|

4 h/day

|

0%

|

7,466,666 MWh

|

23

|

$225/MWh | ($4.50/Watt)

12 h/day

|

30%

|

7,111,111 MWh

|

22

|

$225/MWh | ($4.50/Watt)

4 h/day

|

30%

|

2,370,370 MWh

|

7.35

|

$225/MWh | ($4.50/Watt)

4 h/day

|

0%

|

1,659,259 MWh

|

5.14

| |

This table also contains some additional rows from numbers we’ll discuss below.

Really $50/MWh?

Maybe that $50/MWh is too low. It came in a context of Deutsche Bank estimating $1/Watt for solar panels. Other estimates are higher.

Sara Matasci,

energysage,

October 8, 2016,

What is the Average Cost of Solar Panels in the U.S.?

She estimates up to $4.50/watt for the state of Washington.

So multiply the cost for 645,160 MWh 322,580 MWh by 4.5 or divide the total generated

for $3.2 million by 4.5 or just divide the factor by 4.5, so instead

of 33 times more solar than pipeline power for the buck, only 7.33 times.

Even if you divide again by 3 (4 hours a day instead of 12 hours) (three times even that price),

that’s still a factor of 2.44 cheaper for solar vs gas,

under the worst assumptions that make any sense (highest price per solar Watt,

and fewest hours of solar production per day).

And guess which state Matasci estimates has the lowest price per solar panel Watt?

Florida, at about $2.50/Watt.

So about 33/2.50 = 13.20 times more solar than pipeline power per dollar.

Divide again by 3 (4 hours a day instead of 12 hours) (three times even that price) and

it’s still a factor of 4.4.

What about Subsidies?

What about that 30% federal investment tax credit?

For the cost of 645,160 MWh 322,580 MWh of solar times 6 without that credit,

divide $96,774,000 by 0.70, for $138,248,571, which is still

about 23 times less than Sabal Trail’s $3.2 billion price tag.

Or for what could be built at the same price without that subsidy,

multiply 10,666,666 MWh by 0.70 to get 7,466,666 MWh,

once again about 23 times Sabal Trail’s 645,160 MWh 322,580 MWh.

Sure, the 30% federal tax investment credit is a subsidy, but

- so is the eminent domain FERC gave Sabal Trail,

- so are the permits to drill under rivers, through wetlands, and through the fragile karst limestone containing our drinking water in the Floridan Aquifer,

- so is FPL’s guaranteed annual profit,

- and so is FPL’s rate hike to force its own customers to pay for the rest of the cost.

If we’re talking subsidies, remove federal eminent domain from the federal Natural Gas Act, as recommended by Georgia House Resolution 289, and how many MWh could an interstate natural gas pipeline such as Sabal Trail produce?

None, zero, zilch, nada: 0 MWh. There’s no way to run a 500+-mile pipeline through three states without eminent domain to gouge through those pesky landowners, who don’t want the pipeline, or their property values lowered, or their wildlife or rivers or drinking water disrupted, much less the risk to their life, limb, and taxes through sinkholes, corrosion, leaks, and explosions.

So without subsidies the same amount of money would buy infinitely more electricity from solar power than from natural gas.

Why is FPL still building Sabal Trail, then?

If you were a monopoly utility with a guaranteed profit and a captive Public Service Commission (PSC) to grant you a rate increase, and a captive Federal Energy Regulatory Commission (FERC) to grant you federal eminent domain, you might build a boondoggle like that, too.

There’s a clue in Sabal Trail’s RR10: “(Solar by the Watt, 2009)”. The scheming for what became Sabal Trail goes back to 2009, when its predecessor was actually rejected by the Florida PSC. Back then solar power cost about three times as much.

Jim Weiner, Berkeley Lab, 24 August 2016,

Median Installed Price of Solar in the United States Fell by 5-12% in 2015:

Two new Berkeley Lab studies find record low prices across all sectors

So divide that factor of 33 by 3 and you still get a factor of 11. How did such a pipeline make even financial sense even then? Only if you amortize the cost over ten or more year; maybe 30 or 50 years; the Southern Natural Gas (SONAT) natural gas pipeline through my property is 50 years old.

Which might have made sense 50 years ago, but nowadays is a foolish thing to do. Remember we’re just talking the cost of the pipeline, not even including the cost of the natural gas power plants or the cost of the natural gas itself.

Solar prices keep dropping and deployments doubling

With solar power prices low and going lower, while solar deployment doubles every two years, within less than ten years from 2017 (the projected in-service date for Sabal Trail), more U.S. electricity will come from solar power than any other source. Even FPL will be shutting down piplines by then, not building more. With FPL’s ratepayers still paying down that $3.2 billion.

I’ve got a better idea: cancel the pipeline and spend the rest of the money on solar power!

-jsq

Investigative reporting costs money, for open records requests, copying, web hosting, gasoline, and cameras, and with sufficient funds we can pay students to do further research. You can donate to LAKE today!

Short Link:

Pingback: Valve Turners and fossil fuel divestment | WWALS Watershed Coalition (Suwannee RIVERKEEPER®)