Should Harvard President Drew Faust

worry that

“Significantly constraining investment options risks significantly constraining investment returns”?

Actually, if Harvard has been wasting investments in oil and gas for the

past year, its endowment has lost a bundle.

Ditto VSU.

Should Harvard President Drew Faust

worry that

“Significantly constraining investment options risks significantly constraining investment returns”?

Actually, if Harvard has been wasting investments in oil and gas for the

past year, its endowment has lost a bundle.

Ditto VSU.

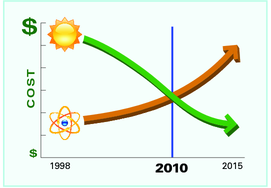

Let’s compare stock performance of Guggenheim Solar ETF (NYSE:TAN) which invests in solar stocks with the PowerShares DB Energy Fund (NYSEARCA:DBE), which invests in oil and natural gas companies. Yep, that’s 120% for TAN and 0% for DBE:

Sure, if you go back farther, solar stocks continued to drop after 2009 until this year:

But that’s the point.

The tipping point has come.

Solar parity

with fossil fuels has been reached (and long since reached with nuclear).

The

long hot smoggy night of burning fossil plants is ending

and

solar power will win like the Internet did.

Soon we’ll see

even Southern Company get out in front on making Georgia and the southeast

a net exporter of solar and wind energy.

But that’s the point.

The tipping point has come.

Solar parity

with fossil fuels has been reached (and long since reached with nuclear).

The

long hot smoggy night of burning fossil plants is ending

and

solar power will win like the Internet did.

Soon we’ll see

even Southern Company get out in front on making Georgia and the southeast

a net exporter of solar and wind energy.

Does Harvard want its endowment portfolio to be left behind?

Does VSU?

Does Harvard want its endowment portfolio to be left behind?

Does VSU?

-jsq

Short Link:

Pingback: Fossil Free Valdosta | On the LAKE front

Pingback: France unfracked | On the LAKE front

Pingback: Solar and wind cheaper than fossil fuels –more evidence | On the LAKE front